GCash is one of the most, if not the biggest online payment method in the Philippines but recently, it has been facing serious security issues.

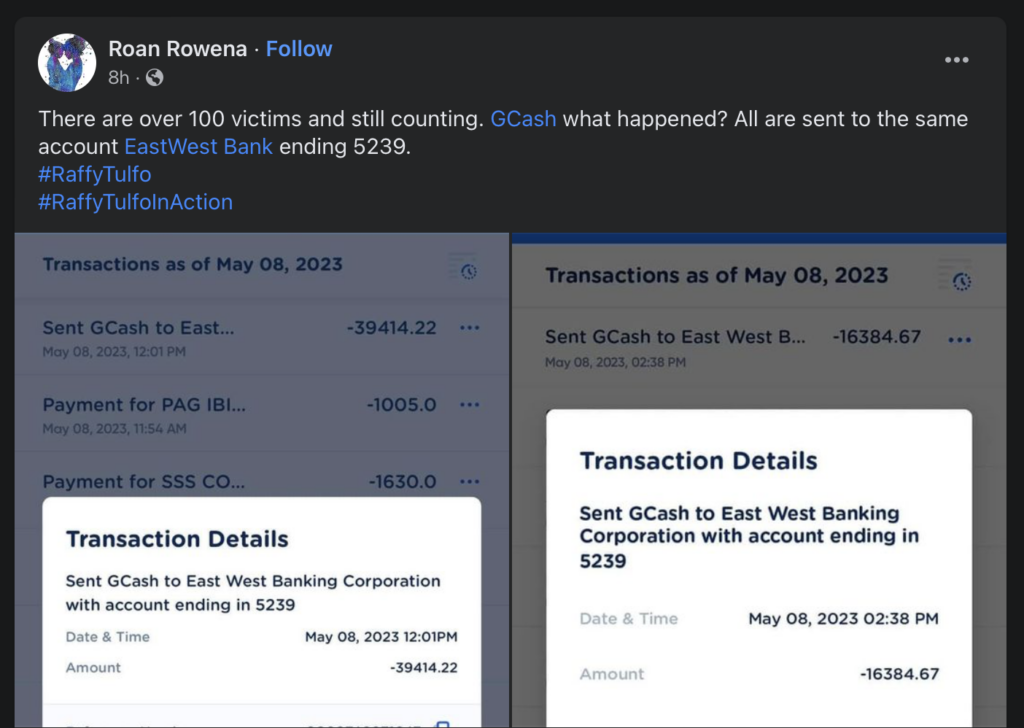

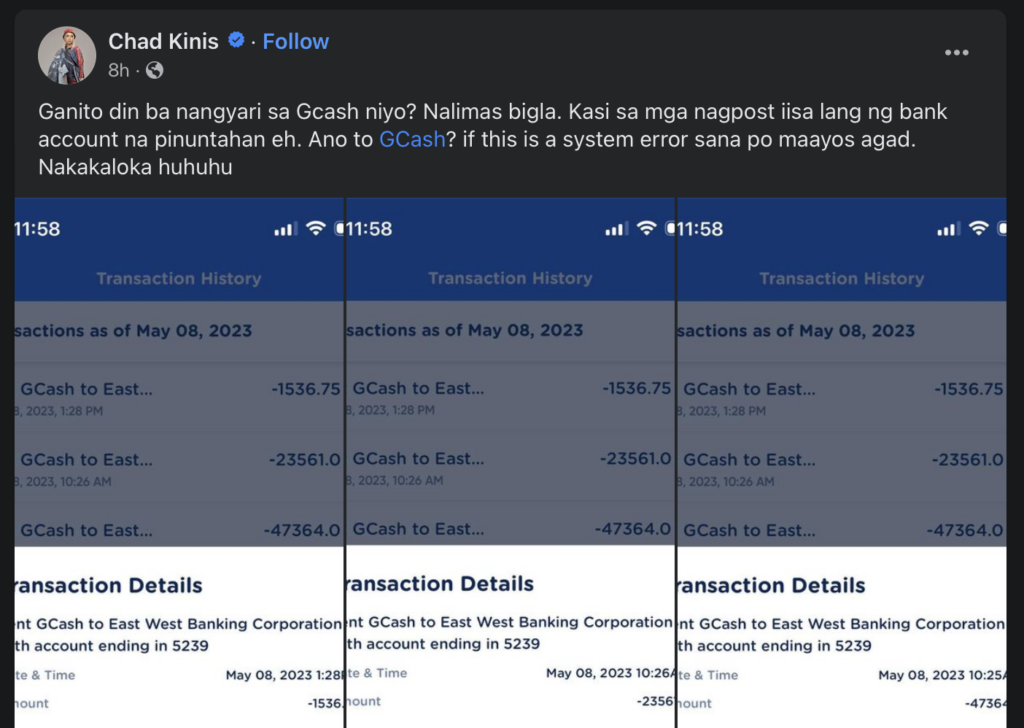

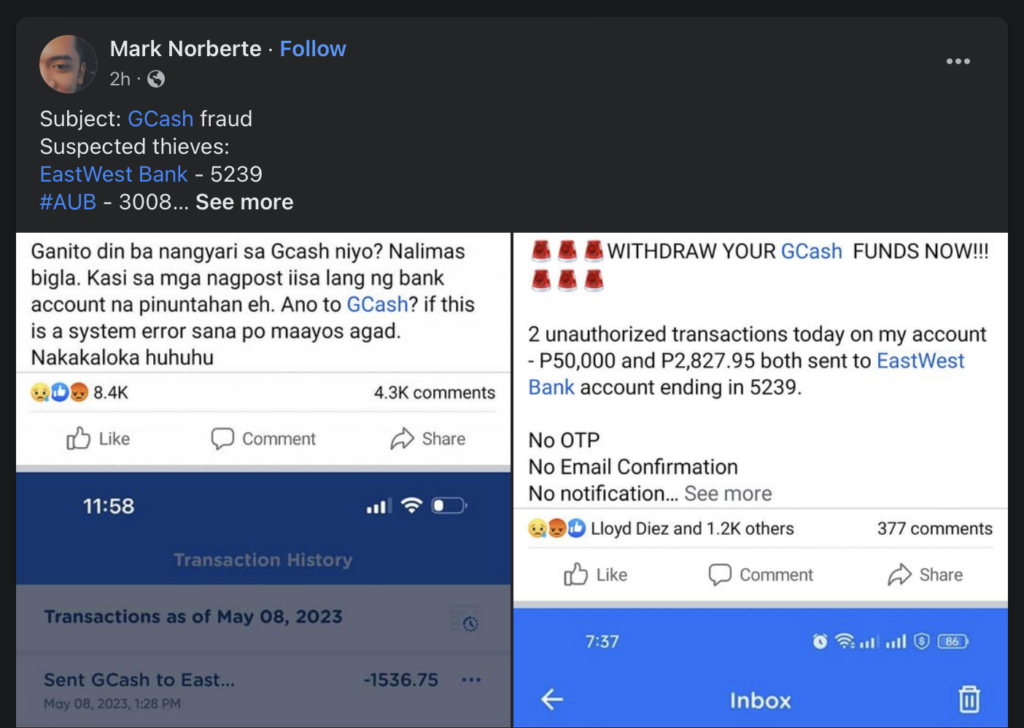

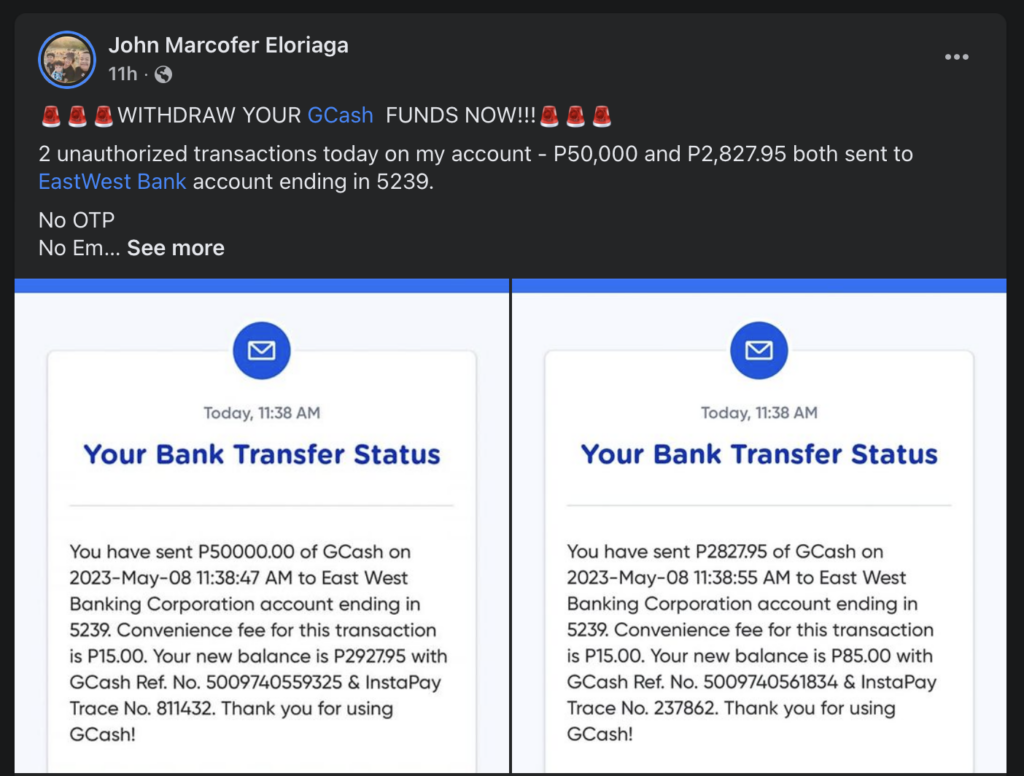

The company is experiencing technical difficulties, and some users speculate that the platform may have been hacked. According to social media posts, some GCash users have lost money in unauthorized transactions. This involves multiple bank accounts, with some victims reporting losses of up to Php 50,000.

GCash is introducing a new security measure requiring users to verify their identity with a live selfie. This feature responded to recent reports of unauthorized transactions that have caused many users to lose money.

It is still unclear if GCash’s security measures, including OTPs and photo ID verification, have been breached. Biometric verification, such as live selfies, is becoming increasingly popular in the fight against fraud and identity theft. Some argue that biometrics are more secure than traditional passwords and PINs, as they are harder to fake or steal.

On the other hand, there are concerns about the privacy implications of biometric verification. Some worry that requiring users to submit selfies and additional personal information could put them at risk of identity theft if this information is breached. Others argue that biometrics could be for surveillance or tracking purposes. It would be more viable if users have the right to opt out of such measures.

While biometric verification may offer more robust security measures, balancing this with protecting users’ privacy and rights is crucial. GCash and other financial institutions must strike this balance as they seek to provide more secure and convenient services to their customers.