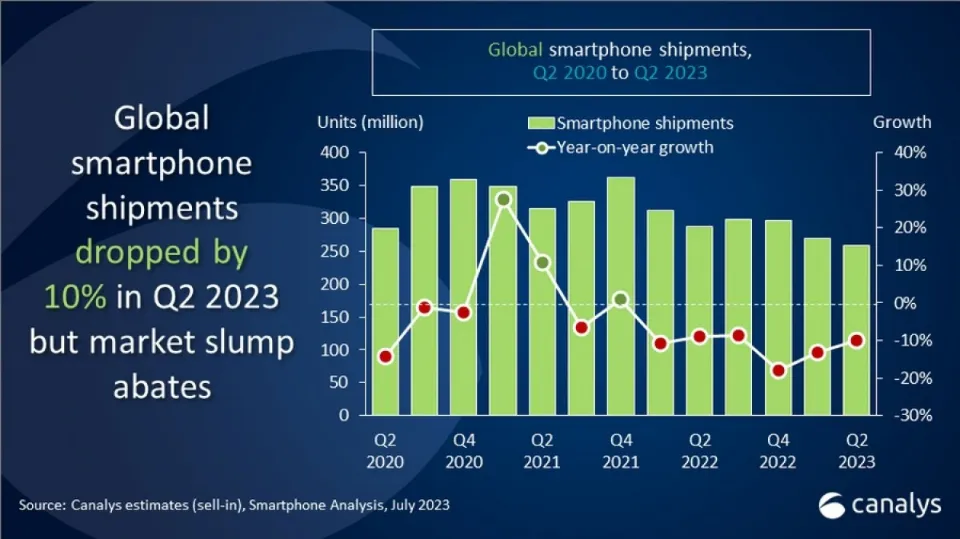

Global smartphone shipments declined by 10% in Q2 2023, but demand is slowly rebounding

According to Canalys, global smartphone shipments totaled 258.2 million units in Q2 2023, down 10% from the same period last year. This marks the sixth consecutive quarter of negative growth.

However, there are some signs of hope. Industry-wide inventory reductions and rising regional market demand are helping to slowly rebound global smartphone demand.

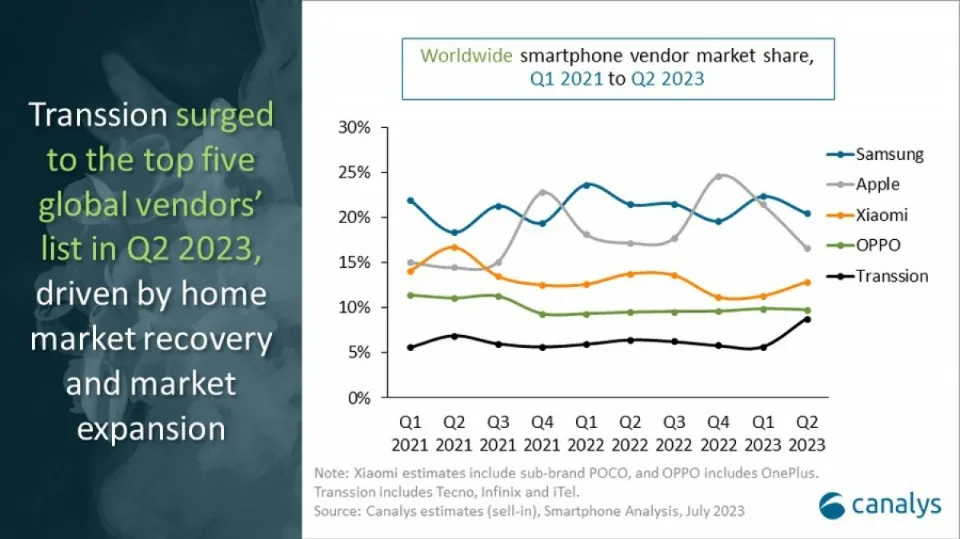

Samsung was once again the leading smartphone brand in terms of shipments for the quarter, with 53 million shipments and a 21% market share. Apple came in second with 43 million shipments and a 17% market share, while Xiaomi rounded out the top three with 33.2 million shipments and a 13% market share.

| Worldwide smartphone shipments and growth Canalys Smartphone Market Pulse: Q2 2023 | |||

| Vendor | Q2 2023 shipments (million) | Q1 2023 market share | Annual growth |

| Samsung | 53.0 | 21% | -14% |

| Apple | 43.0 | 17% | -13% |

| Xiaomi | 33.2 | 13% | -16% |

| Oppo | 25.2 | 10% | -8% |

| Transsion | 22.7 | 9% | +22% |

| Others | 81.1 | 31% | -11% |

| Total | 258.2 | 100% | -10% |

| Note: Percentages may not add up to 100% due to rounding. Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Transsion includes Tecno, Infinix and iTel. Source: Canalys estimates (sell-in shipments), Smartphone Analysis, July 2023 | |||

Transsion showed a strong growth in emerging markets

Transsion, which owns the Infinix, Tecno, and iTel brands, has seen strong growth in emerging markets, particularly in the Middle East, Africa, and Latin America. This has helped the company to move into fifth place in the global smartphone market, with 22.7 million shipments and a 9% market share.

Transsion’s growth is being driven by its focus on affordability and its ability to meet the needs of consumers in emerging markets. The company’s products are typically priced below $200, and they offer a good balance of features and performance.

Looking ahead, Canalys analysts predict that smartphone demand will continue to decline moderately in the second half of 2023. However, the business environment is expected to improve, and vendors that are able to adapt to long-term structural changes will be successful.

Transsion is well-positioned to succeed in the long term, as it has a strong focus on emerging markets and a track record of innovation. The company is also one of the few smartphone brands that is still growing, which gives it an advantage over its competitors.